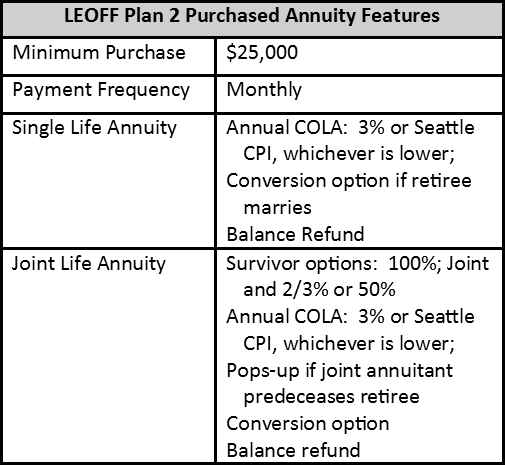

It is never too early, or too late, to start preparing for the retirement you envision. Creating a strategy for retirement can help you live with more security and fewer uncertainties – both now and after you retire. No matter what you see yourself doing in retirement - spending time with family and friends, traveling, or starting a new hobby - you'll need income. What should I be saving? Retirement savings can be thought of as a 3-legged stool: a pension, personal savings, and Social Security. Since the majority of LEOFF Plan 2 members are not enrolled in Social Security, it puts a larger emphasis on your personal savings. That emphasis was at the forefront of the proposal to allow LEOFF Plan 2 members to purchase an annuity out of the LEOFF Plan 2 trust fund. This additional annuity will help by providing you with guaranteed lifetime income, so you can make the most of the money available to you during retirement. So how does this annuity work? At the time of retirement, you can roll your retirement savings from a tax qualified plan into LEOFF Plan 2. The Department of Retirement Systems (DRS) will convert this rollover into a monthly life annuity. Because you are rolling over from a tax qualified savings plan, you do not have to pay taxes at the time you purchase the annuity. Instead, the money will be included in your taxable income as you receive it.

You will receive your pension dollars as well as this annuity in one monthly check from DRS. If you were to pass away before you received the initial cost to purchase the annuity, your beneficiary would receive the balance. What other annuities are out there? Many private annuity companies offer them. However, LEOFF’s higher interest rate assumption (7.5% - compared to around 4% for a private annuity company) translates into a larger annuity from the same lump sum. Additionally, administrative cost to the member are much lower. Questions? Contact the Department of Retirement Systems (DRS) at 1-800-547-6657.